Tracking gold and silver price trends helps investors make informed buying decisions and avoid overpaying during volatile market cycles. Using daily bullion rate data and simple analysis methods, new and small city investors can monitor movements without relying on complex financial tools.

Why tracking gold and silver prices matters for new investors

The main keyword gold and silver price trends appears naturally here because understanding daily movements is essential for anyone planning long term or short term investment in precious metals. Prices fluctuate based on global demand, currency shifts, central bank activity and domestic market conditions. For Indian buyers, bullion rates vary across cities due to logistics, tax differences and local jeweller premiums. Consistent tracking helps investors identify entry points when prices dip and avoid buying during sudden spikes driven by short lived market sentiment.

Gold remains a preferred savings instrument in India while silver attracts buyers interested in industrial usage growth and moderate price appreciation. Small investors in Tier 2 and Tier 3 cities often rely on jeweller quotes, which may not always reflect real time market data. Using verified daily bullion rates provides a more accurate foundation for investment decisions and helps distinguish genuine fluctuations from seller driven pricing.

Use daily bullion data to identify short term price movement patterns

A reliable starting point is to check daily bullion data available through financial platforms and commodity exchanges. Secondary keywords like daily gold rates and silver price updates fit naturally here because frequent monitoring highlights small but meaningful shifts. Investors should observe how prices change over a one week and one month timeline. These shorter cycles reveal whether metals are trending upward, stabilising or entering a correction phase.

Short term price patterns often reflect external influences such as global interest rate announcements, geopolitical events or currency strength. For example, gold usually rises when global uncertainty increases while silver reacts more sharply to industrial demand changes. Plotting daily prices in a simple spreadsheet helps visualise patterns and prevents emotional decision making based on single day movements.

Track long term price trends using monthly and yearly averages

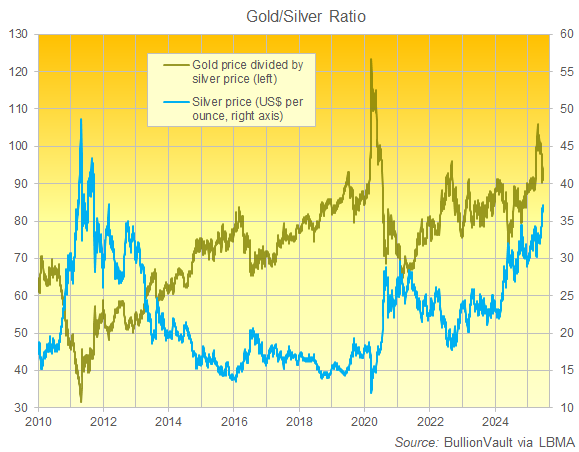

Long term trend analysis provides stability for investors who plan to buy gold or silver with a multi year horizon. Monthly and yearly averages reduce noise from daily volatility. A secondary keyword like long term bullion trends supports this section naturally. Comparing average prices over six month and twelve month periods helps investors understand whether the current rate is above or below the broader trend.

Gold often follows multi year cycles influenced by global economic health. During expansion periods, prices soften as investors prefer equities. During slowdowns, gold typically strengthens as a safe haven asset. Silver, on the other hand, shows mixed movement because it serves both as an industrial metal and an investment metal. Tracking these broader cycles helps investors decide whether current levels align with long term opportunity or risk.

Use city specific bullion data to identify local pricing differences

Bullion prices differ between metros and smaller cities due to transportation costs, purity variations and jeweller premiums. A buyer in a Tier 2 city may see slightly higher or lower prices depending on local market competition. A secondary keyword like bullion rates by city works well here because comparing local rates with national averages helps identify if a jeweller quote is fair.

Investors should check the price for both 24 karat and 22 karat gold as well as silver in kilograms and grams. Even small differences matter when buying larger quantities. Maintaining a daily log of local rates creates a reference that helps buyers negotiate better with jewellers and avoid overpaying during festival seasons when premiums rise.

Monitor global indicators that influence bullion movement

Gold and silver react strongly to macro indicators such as global inflation, crude oil prices, currency strength and central bank policies. Tracking these indicators does not require advanced financial knowledge. A secondary keyword like global market signals fits well because these signals often foreshadow domestic bullion changes.

For example, when the US dollar weakens, gold prices usually strengthen worldwide. When central banks increase their gold reserves, long term upward pressure builds. Silver gets influenced by industrial data from sectors like electronics, solar and manufacturing. Recognising these external factors allows investors to anticipate movements instead of reacting after the price has already moved.

Use simple technical indicators for better timing

Even new investors can use basic technical indicators to understand price behaviour. Tools like moving averages, support levels and resistance levels help determine whether metals are overvalued or undervalued at the moment. A 30 day moving average shows short term stability while a 200 day moving average reflects long term sentiment. When prices stay consistently above key averages, it signals strength. When they fall below, it suggests weakening momentum.

Investors do not need advanced charting platforms. Many free tools offer simple line charts where these indicators can be applied. Technical analysis does not predict exact prices but provides clarity on trend direction and helps avoid impulsive purchases.

Takeaways

Track daily and weekly bullion rates to spot short term trends

Use monthly and yearly averages for long term investment decisions

Compare city specific rates to identify unfair local premiums

Monitor global economic indicators that influence gold and silver movement

FAQs

Why do gold and silver prices vary across Indian cities

Local taxes, transport costs and jeweller premiums create pricing differences between regions and cities.

Is daily tracking necessary for long term investors

Not mandatory, but daily checks help avoid buying during temporary spikes and improve timing.

Which is more volatile, gold or silver

Silver is generally more volatile because it depends heavily on industrial demand in addition to investment demand.

How can beginners start tracking bullion trends without complex tools

Use simple daily rate charts, moving averages and city wise comparisons to build a clear picture of price movement.

Leave a Reply