Claiming and tracking an income tax refund in India has become a common concern as processing timelines, mismatches, and verification delays continue to affect taxpayers. This practical guide explains how to correctly claim your refund and monitor its status without errors or unnecessary follow ups.

Understanding how an income tax refund works

An income tax refund arises when the tax you have paid during a financial year exceeds your actual tax liability. This often happens due to excess TDS deducted by employers, banks, or clients, advance tax overpayment, or incorrect tax estimation. To receive a refund, filing your income tax return correctly is mandatory. The refund is not automatic and depends on accurate reporting, verification, and processing by the Income Tax Department. Refunds are issued only after the return is processed and validated against available tax records.

Filing your income tax return correctly to claim refund

The first and most important step in claiming an income tax refund is filing the correct ITR form. Salaried individuals usually file ITR 1 or ITR 2, while professionals and business owners use ITR 3 or ITR 4 depending on income type. Ensure that your PAN, Aadhaar, and bank account details are correctly linked. All TDS entries shown in Form 26AS and AIS should match the income declared in your return. Any mismatch can delay refund processing or trigger scrutiny.

Verifying your return to initiate refund processing

After filing your return, verification is mandatory. Without verification, the refund process does not start. You can verify your return electronically using Aadhaar OTP, net banking, bank account validation, or demat account. If electronic verification is not completed within the prescribed timeline, you must send a signed physical ITR V acknowledgment to the Centralized Processing Centre. Delayed verification is one of the most common reasons for refund delays among taxpayers.

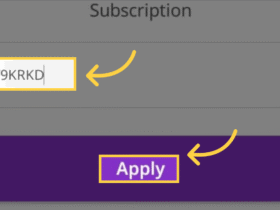

How to check income tax refund status online

Once your return is verified, you can track the income tax refund status online. Log in to the income tax e filing portal using your PAN credentials. Under the e file section, select income tax returns and view filed returns. The status will show whether the return is processed, refund issued, or refund failed. If the refund has been issued, the portal also displays the refund amount and reference number for bank tracking.

Tracking refund through bank and refund reissue process

After the refund is marked as issued, it usually reaches the registered bank account within a few working days. If the refund fails due to incorrect bank details, inactive account, or name mismatch, the status will reflect refund failed. In such cases, you must update your bank details and request a refund reissue through the portal. Ensure that the bank account is pre validated and linked with PAN before raising the request.

Common income tax refund issues and how to fix them

Refund delays often occur due to incorrect bank information, mismatches between TDS data and declared income, or pending verification. Another frequent issue is partial refunds caused by tax recalculation by the department. In such cases, the department sends an intimation explaining the adjustment. Carefully review the intimation and respond if there is a disagreement. Ignoring these communications can result in refund denial or future notices.

What to do if your income tax refund is delayed

If your refund is delayed beyond the usual processing time, check whether your return status shows processed or under verification. You can also raise a grievance through the e filing portal under the grievance section. This allows you to report refund related issues directly. Avoid filing duplicate returns or repeatedly raising requests, as this can slow down resolution. Keeping copies of acknowledgments and intimation notices helps during grievance follow ups.

Importance of keeping tax records for refund follow up

Maintaining proper tax records such as Form 16, Form 26AS, AIS, and acknowledgment receipts makes refund monitoring easier. These documents help identify mismatches quickly and support your case if clarification is needed. Organized records also reduce errors during filing, which directly improves refund speed and accuracy.

Takeaways

Income tax refunds are issued only after correct filing and verification of returns

Matching TDS details with Form 26AS and AIS is critical for faster refunds

Refund status can be tracked easily through the income tax e filing portal

Most refund delays are caused by bank detail errors or pending verification

FAQs

How long does it take to receive an income tax refund in India?

Refund timelines vary, but most refunds are issued within a few weeks after return processing if all details are correct.

Can I change bank details after filing my return?

Yes, you can update and pre validate bank details on the portal and request a refund reissue if needed.

What happens if my refund is adjusted against old tax dues?

The department sends an intimation explaining the adjustment. You can accept it or respond if there is a discrepancy.

Is refund possible without filing an income tax return?

No, filing and verifying your return is mandatory to claim any income tax refund.

Leave a Reply