Tracking and interpreting stock market technical signals is one of the most practical skills a beginner can develop. Stock market technical signals help investors understand price behaviour, momentum, and potential trend changes using charts and indicators rather than company fundamentals.

Understanding Technical Analysis and Market Setup Basics

Stock market technical signals are based on the idea that price reflects all available information. Instead of analysing earnings or balance sheets, technical analysis studies price movement, volume, and historical patterns. For beginners, market setup basics mean identifying whether the broader market is trending up, trending down, or moving sideways.

A trending market usually offers clearer opportunities, while sideways markets require caution. Before analysing individual stocks, beginners should first check benchmark indices to understand overall sentiment. If the index is making higher highs and higher lows, the market setup is considered positive. If lower highs and lower lows dominate, the setup is weak. This context helps avoid trading against the prevailing trend.

Reading Price Charts the Right Way

Price charts are the foundation of technical analysis. Beginners should start with simple line charts to understand direction, then move to candlestick charts for more detail. Candlesticks show opening price, closing price, and intraday highs and lows, offering insights into buying and selling pressure.

A series of strong bullish candles indicates sustained demand, while repeated long red candles suggest selling pressure. Beginners should avoid over analysing single candles and instead focus on patterns forming over several sessions. Consistency matters more than isolated signals. Charts should always be viewed on at least two timeframes, such as daily and weekly, to avoid short term noise.

Key Technical Indicators Beginners Should Learn First

Technical indicators help quantify price behaviour. Moving averages are the most beginner friendly tools. A 50 day and 200 day moving average combination is widely used to identify medium and long term trends. When prices trade above these averages, momentum is generally positive.

Relative Strength Index, or RSI, measures momentum and potential overbought or oversold conditions. Values above 70 suggest overheating, while below 30 indicates weakness. Beginners should use RSI as a supporting signal, not a standalone trigger. Volume indicators are equally important. Rising prices with rising volume confirm strength, while rising prices on falling volume may signal exhaustion.

Identifying Support, Resistance, and Breakouts

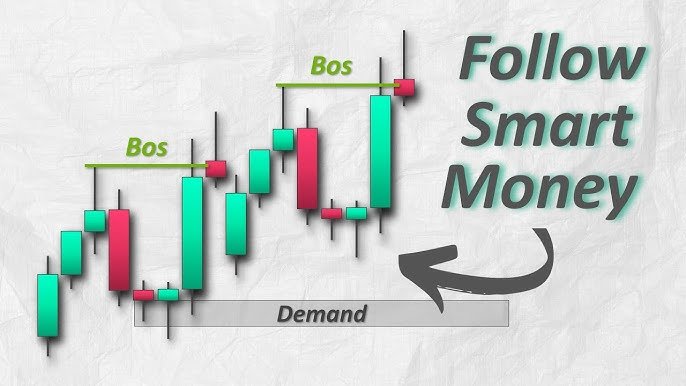

Support and resistance levels are price zones where stocks tend to pause or reverse. Support is where buying interest emerges, while resistance is where selling pressure increases. Beginners can identify these zones by marking areas where prices repeatedly bounced or stalled.

Breakouts occur when price moves decisively above resistance or below support with strong volume. These moments often signal the start of a new trend. False breakouts are common, so confirmation is critical. Waiting for a daily close above resistance reduces the risk of acting too early. This discipline is part of understanding market setup basics and avoiding emotional decisions.

Understanding Trend Strength and Market Breadth

Trend strength shows whether a move is likely to continue. Tools like trendlines help visualise direction. An upward sloping trendline connecting higher lows suggests sustained buying interest. When prices break below a rising trendline, it may signal weakening momentum.

Market breadth indicators look beyond individual stocks and assess how many stocks are participating in a move. If an index is rising but only a few stocks are advancing, the trend may lack durability. Beginners can observe how many stocks are making new highs versus new lows to judge overall health.

Common Mistakes Beginners Must Avoid

One major mistake is using too many indicators at once. This leads to confusion and conflicting signals. Beginners should stick to a small set of tools and learn them well. Another error is ignoring risk management. Technical signals indicate probability, not certainty.

Placing stop losses below support levels protects capital when signals fail. Beginners often hesitate to exit losing trades, hoping the market will reverse. Discipline matters more than prediction. Trading without understanding the broader market setup is another common pitfall that leads to inconsistent results.

Building a Simple and Repeatable Technical Strategy

A beginner friendly strategy combines trend direction, price structure, and one momentum indicator. For example, trade only stocks above the 200 day moving average, wait for pullbacks near support, and use RSI to confirm momentum. This approach reduces noise and improves consistency.

Keeping a trading journal helps track which signals work and which do not. Over time, patterns emerge that refine decision making. Technical analysis is a skill that improves through repetition, observation, and controlled risk rather than constant strategy changes.

Takeaways

Stock market technical signals help beginners understand price behaviour and trends

Market setup basics start with analysing broader index direction

Simple indicators like moving averages, RSI, and volume are enough initially

Risk management and discipline matter more than predicting market moves

FAQs

Is technical analysis suitable for long term investors?

Yes, long term investors can use technical signals to improve entry and exit timing while still focusing on fundamentals.

How much time does a beginner need to learn technical analysis?

Basic concepts can be learned in weeks, but consistent interpretation takes months of practice.

Can technical signals work in volatile markets?

They can, but volatility increases false signals. Broader market setup becomes even more important in such conditions.

Should beginners trade daily using technical analysis?

Not necessarily. Beginners often perform better using daily or weekly charts rather than intraday trading.

Leave a Reply