The funding slowdown in India’s startup ecosystem has become a defining reality for founders navigating late-stage investment dips, forcing a shift from growth-at-all-costs to disciplined execution and capital efficiency. This phase is not a collapse but a correction, and how founders respond now will determine long-term survival and valuation outcomes.

Understanding The Current Funding Slowdown Context

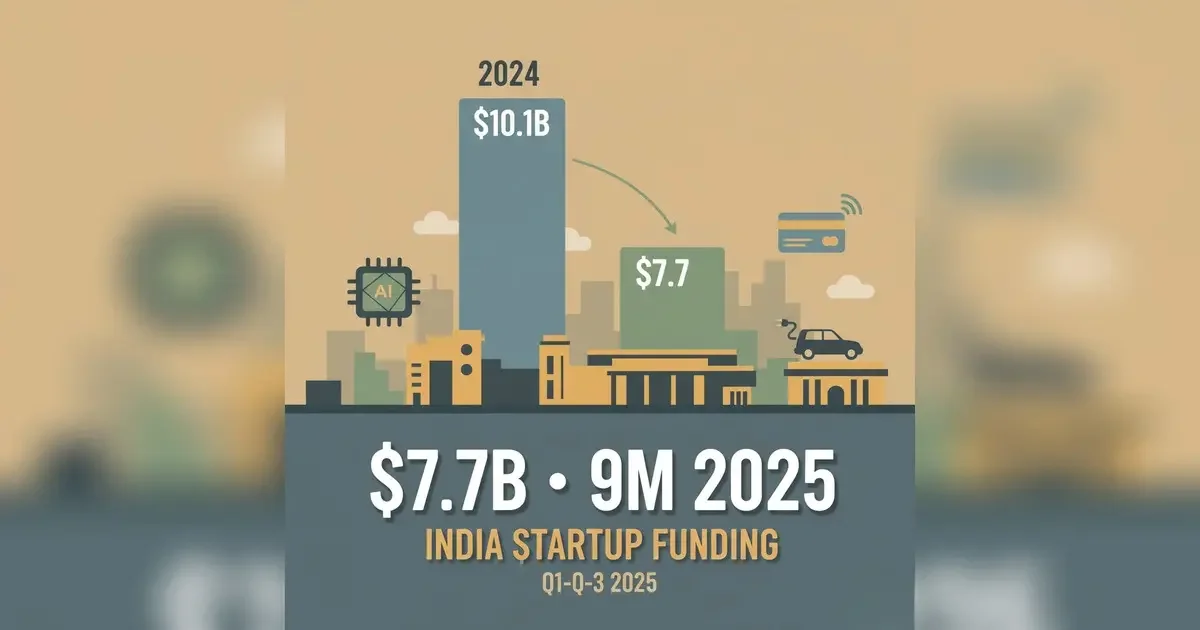

The funding slowdown in India’s startup ecosystem is best understood as a recalibration rather than a freeze. Late-stage capital has tightened due to global monetary conditions, cautious institutional investors, and underwhelming exit activity. Growth rounds that were routine two years ago now face extended diligence cycles, valuation resets, and stricter unit economics scrutiny.

Late-stage investors are prioritising profitability signals, predictable cash flows, and governance maturity. Companies built primarily on aggressive expansion narratives without clear contribution margins are finding it harder to close rounds. This shift affects Series C and beyond more than early-stage funding, where innovation and founder potential still attract capital.

For founders, recognising that this slowdown is structural rather than temporary is the first strategic step.

Reframing Growth Metrics For Late Stage Survival

During capital-heavy years, scale metrics dominated founder conversations. Gross merchandise value, user growth, and market share were often prioritised over margins. In the current environment, late-stage investment dips demand a reframing of what growth means.

Founders must focus on metrics that signal durability. Revenue quality, cohort retention, contribution margin, and payback periods now carry more weight than topline growth alone. Investors want proof that the business can sustain itself without continuous capital infusion.

This does not mean abandoning growth. It means demonstrating controlled growth where every rupee spent has a measurable return. Companies that successfully make this shift often find renewed investor interest despite broader market caution.

Cash Management Becomes A Core Leadership Skill

One of the most critical responses to a funding slowdown is rigorous cash discipline. Runway planning can no longer assume easy follow-on rounds. Founders should model multiple downside scenarios and extend runway proactively rather than reactively.

This includes renegotiating vendor contracts, rationalising non-core expenses, and reassessing expansion plans. Hiring should be tightly aligned with revenue generation or operational efficiency. Teams that grew rapidly during boom cycles may need restructuring to match current realities.

Strong cash management sends a clear signal to investors that leadership understands the new operating environment. It also preserves optionality, giving founders leverage in future funding discussions.

Rethinking Valuation Expectations And Deal Structures

Late-stage investment dips often come with valuation pressure. Founders holding onto peak-cycle valuation benchmarks risk stalling deals entirely. Accepting valuation resets does not equal failure. It reflects market maturity.

Smart founders approach negotiations with flexibility on structure rather than fixating on headline valuation. Instruments such as structured equity, performance-linked tranches, or partial secondary liquidity can bridge expectation gaps.

The goal is not to protect ego but to protect the company. A slightly lower valuation with strong capital partners and operational runway is far better than a stalled business waiting for ideal terms that may never return.

Strengthening Governance And Investor Confidence

As funding slows, governance standards become non-negotiable. Late-stage investors scrutinise compliance, financial reporting, and board discipline more closely than ever. Weak internal controls can kill deals regardless of business potential.

Founders should invest time in strengthening finance teams, improving reporting cadence, and ensuring clean cap tables. Transparent communication with existing investors builds trust and can unlock bridge funding or strategic introductions.

Companies that treat governance as a growth enabler rather than a burden are better positioned to attract capital even in cautious markets.

Exploring Alternative Capital And Strategic Options

Traditional venture capital is no longer the only viable growth fuel. During funding slowdowns, founders should explore alternative capital sources such as venture debt, revenue-based financing, and strategic partnerships.

Strategic investors, including large corporates, often look beyond short-term market cycles. They value long-term alignment, market access, and operational synergies. While such deals may take longer to close, they can provide stability and validation.

Founders should also consider whether slower, profitable growth could outperform aggressive expansion funded by expensive capital. In many cases, sustainability becomes a competitive advantage.

Mental Reset For Founders And Leadership Teams

Beyond numbers, funding slowdowns test founder mindset. The pressure of late-stage investment dips can lead to reactive decision-making or burnout. Strong leaders use this phase to reset priorities, simplify execution, and rebuild internal focus.

Clear communication with teams is essential. Uncertainty breeds attrition if not addressed openly. Founders who articulate a credible plan and demonstrate personal conviction often retain talent even during tough phases.

This period rewards operators over storytellers. Execution consistency now matters more than pitch decks.

Takeaways

Funding slowdown in India’s startup ecosystem reflects a structural correction, not a collapse

Late-stage founders must shift focus from scale to sustainable unit economics

Cash discipline and governance strength directly influence investor confidence

Flexible deal structures and alternative capital can unlock growth during slowdowns

FAQs

Why is late-stage funding harder to raise than early-stage capital right now?

Because late-stage investors prioritise profitability, exits, and capital preservation during uncertain global conditions.

Should founders accept lower valuations during a funding slowdown?

If it secures runway and strong partners, valuation resets are often a strategic move rather than a setback.

Is venture debt a good option during funding dips?

It can be effective for companies with predictable cash flows, but it requires disciplined repayment planning.

How long could this funding slowdown last?

Market cycles vary, but founders should plan for extended caution rather than a quick rebound.

Leave a Reply