Rupee depreciation against the US dollar directly affects remittances and household budgets, and the main keyword appears naturally here. Families in smaller cities experience both gains and pressures as currency movements reshape income flows, essential expenses and long term financial planning.

Why the rupee weakens against the dollar and why it matters (currency movement basics)

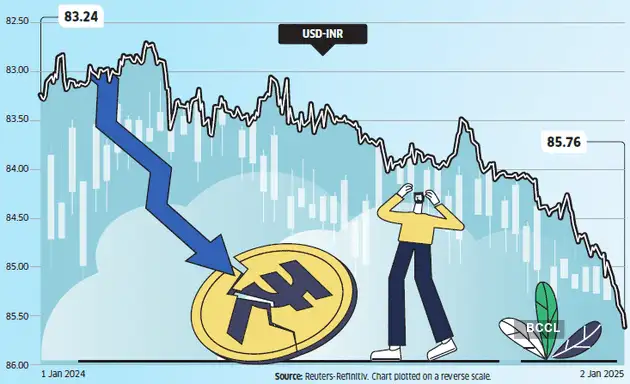

The rupee depreciates when global investors move funds into safer assets, when crude oil prices rise or when domestic growth shows signs of slowing. India’s import heavy economy increases dollar demand during uncertain periods, making the local currency more sensitive to global shifts. When the rupee loses value, imported goods become more expensive and overseas payments require additional rupee outflow. This matters for households because several daily cost components, including fuel and cooking gas, depend on global pricing. In smaller cities where incomes rise slowly and job opportunities vary across sectors, currency weakening introduces additional financial strain. At the same time, families receiving remittances from Gulf countries, the US or Europe may gain in rupee terms as the converted value increases.

How rupee depreciation influences remittance inflows for families (income boost effects)

Remittances become more valuable when the rupee weakens because each dollar or dirham converts into a higher amount of local currency. For households relying on overseas workers in regions such as the Middle East or North America, this creates a temporary income boost. Families often use this additional value to fund education, home construction or agricultural investments. However, the gain depends on international wage stability and employment conditions. If overseas expenses rise simultaneously, the net benefit may reduce. Transaction fees and exchange rate margins charged by banks or remittance apps also shape the final amount. Many families in Tier 2 and Tier 3 towns rely heavily on these inflows to manage monthly expenses, so even small fluctuations influence their purchasing power. Understanding forex trends helps families time transfers optimally.

Why household expenses rise during rupee depreciation in smaller towns (inflation and supply chain impact)

Transport costs increase when fuel becomes expensive. As a result, prices of vegetables, groceries and essential commodities rise in local markets. Smaller towns face stronger impact because supply chains are longer and rely heavily on road transport. LPG cylinders and related household energy costs increase as well, straining budgets for families with fixed incomes. Electronics, mobile phones and imported appliances become costlier, delaying purchase decisions. Students preparing for overseas exams or planning international education face higher expenses due to rising application fees and visa related costs, most of which are priced in dollars. Healthcare costs also rise when imported medical equipment or drugs become expensive. These combined pressures reduce discretionary spending and shift household priorities toward essential needs.

How small businesses and local workers are affected by currency weakening (employment and income impact)

Local businesses in textiles, retail, food supply and manufacturing face margin pressure when input costs rise. Smaller enterprises often cannot immediately increase prices because consumer spending weakens during inflation. This margin squeeze leads to slower hiring and reduced wage growth. Workers in transport, construction and service sectors experience inconsistent income because demand fluctuates. Remittance receiving families may experience increased liquidity, but others face tightened budgets that reduce demand for local goods. For example, carpenters, tailors and electricians often report fewer orders during inflationary cycles. Agricultural households face mixed impact. Export oriented crops become more profitable due to better dollar realisation, but fertiliser and machinery imports become costlier. These variations create complex financial conditions across communities.

How households can manage budgets during periods of rupee depreciation (practical planning guidance)

Families should first track recurring expenses and identify categories affected by external pricing. Fuel usage can be optimised through carpooling or switching to public transport when feasible. Bulk purchasing of non perishable goods helps counter price volatility. For households receiving remittances, timing transfers during favourable forex levels increases monthly income. Maintaining part of remittance savings in stable financial instruments protects against future fluctuations. Students planning overseas education should calculate revised budgets earlier and secure fee locks where possible. Small business owners can renegotiate supplier contracts, explore local substitutes for imported inputs and adjust pricing gradually. Households should also create emergency buffers because inflation periods often lead to unexpected expenditure. Monitoring bank alerts, forex apps and fuel price trends ensures timely decision making.

Why the currency cycle also creates long term opportunities (strategic perspective for families and towns)

Currency cycles expose vulnerabilities but also highlight areas for improvement. Towns that develop stronger local supply chains reduce dependence on imported goods over time. Families using remittance gains for productive investments such as skill development or micro enterprises can create more resilient income streams. As digital remittance platforms expand, transaction costs decline, enabling households to retain more value from overseas earnings. Investment in renewable energy solutions like solar rooftops helps reduce sensitivity to fuel volatility. Local businesses adopting efficient logistics and digital tools may strengthen competitiveness even during economic fluctuations. Understanding currency movements encourages informed financial behaviour instead of reactive spending. For communities in smaller towns, resilience improves when financial planning aligns with broader economic cycles.

Takeaways

• Rupee depreciation increases remittance value but raises essential household expenses

• Transport, fuel and imported goods become costlier, affecting small town budgets

• Small businesses face margin pressure and slower hiring during currency weakening

• Households can manage impact through careful planning, timing transfers and reducing volatility exposure

FAQs

Does rupee depreciation always benefit remittance receiving families

It usually increases the converted value, but the net benefit depends on overseas income stability and transfer fees.

Why do prices rise faster in smaller towns during currency weakening

Longer supply chains and higher transport dependence lead to quicker price transmission.

How can households protect savings during volatile currency periods

By diversifying savings, reducing imported consumption and tracking essential price trends regularly.

Will the rupee recover after depreciation cycles

Currencies move in cycles based on global and domestic factors. Recovery depends on economic stability, trade balance and investor confidence.

Leave a Reply